Every dollar you have is important when you are in college. Having a good social life costs money, and you must pay for things like food, books, rent or a car, and school. Also, problems happen all the time. For example, you might need an essay writing service to help you with your paper or fix or upgrade your laptop. But how do you save money when your budget is already pretty tight? Different budgeting apps are the answer.

Budgeting apps can help you establish responsible spending habits, figure out where your money goes, and figure out what you can do to save some each month. Here are the five best budgeting apps every college student should check out.

1. Mint

It is only possible to put together a list of the best budgeting apps with Mint. Once you start using it, you’ll understand why it has constantly been one of the most well-liked apps of this kind for the past few years. You can join all of your bank accounts to Mint in one place. The app then keeps track of all of your transactions, as well as all of your purchases, saving you the trouble of typing them directly.

It also has alerts that let you know when it’s time to pay your bills, as well as if you have less money than planned at that point. If you choose to use Mint, you can spend less.

2. EveryDollar

You can see just how your budget is being spent with EveryDolar. This app allows you to put all the money into your pocket or rent account, whether from your parents, savings, or a part-time job. You will get a good idea of how you can also save some money by doing this month after month and putting your money where it is most needed.

Because you can put some of the money away as a backup, this is especially helpful if your income doesn’t stay the same each month. You can get helpful budgeting tips from EveryDollar in several ways, including the app itself, emails, and blog posts.

3. GoodBudget

GoodBudget is another budgeting app that you should check out. This app does not link to any of your bank accounts, unlike some of the apps on this list. Instead, it allows you to set up an envelope method to divide your income into several different rent groups, each with its envelope. This is the digital form of the system that has been around for a long time. You can keep track of each cost once your money is split up among these boxes.

All of this has to be done by hand, which could be a good thing because it forces you to check your spending more often.

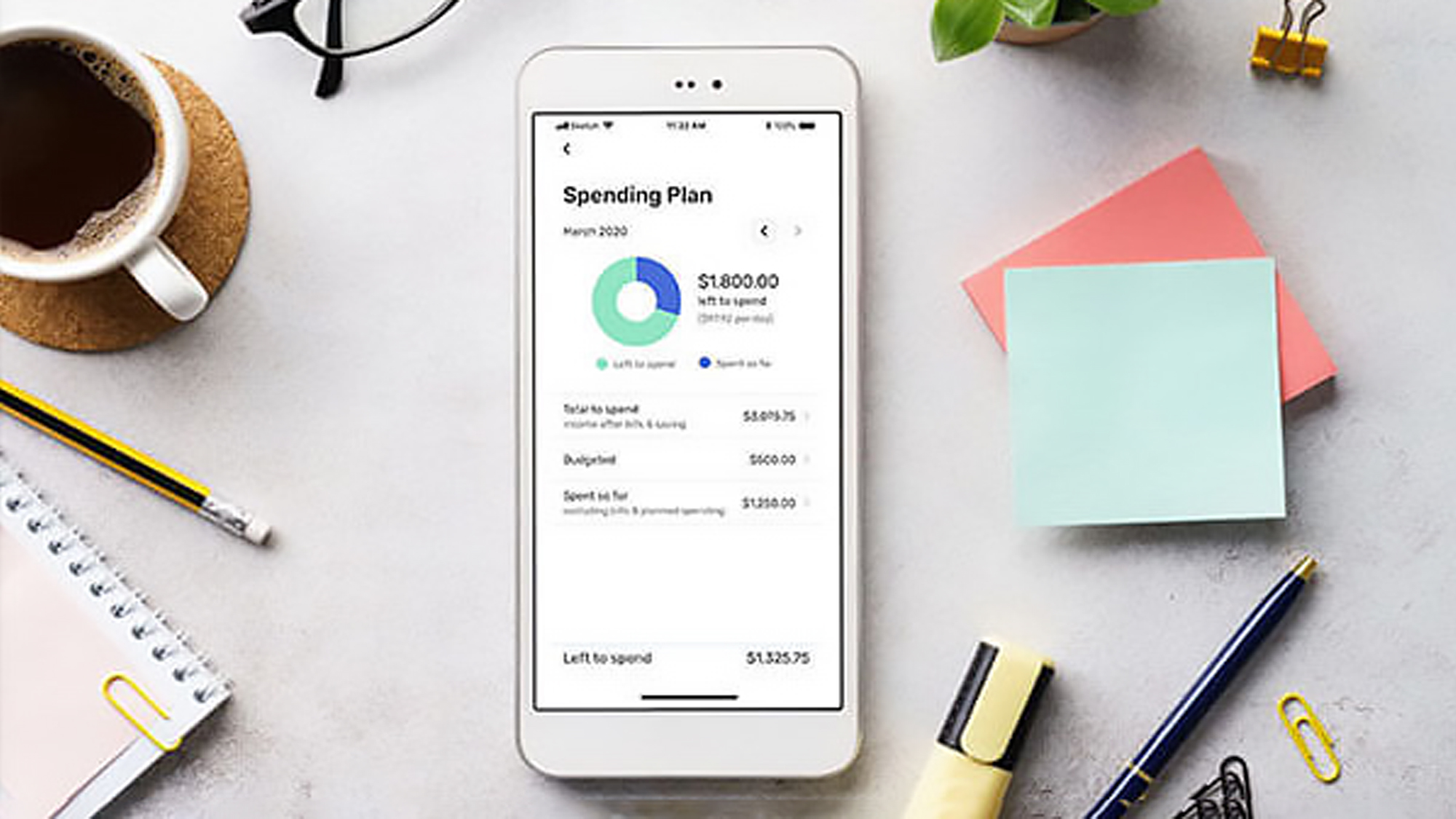

4. PocketGuard

If you want to stop spending too much, PocketGuard might help. With its easy-to-use design, this app makes it easy for you to keep track of all of your expenses, even the money you have left over after paying all of your monthly bills. It also has a pie chart tool that shows how much each area costs you each month, which is great if you don’t like numbers and would rather see things.

You can also link all of your credit and debit cards, as nicely as your bank accounts, to the app, giving you a full picture of all your money at all times.

5. Splitwise

You maye these days, given how much rent costs. You need to be able to keep track of all the costs that you and your friend share. We want everyone to make sure they pay their fair share. For people who split expenses like rent, energy bills, or even food, Splitwise is the best budgeting app. All of the arriving cash or online payments are recorded, as well, making it easy to keep track of your amount and different costs.

This app not only saves you money but also keeps you from having to deal with many bad things, like friends fighting over money.

Final Word

Being a college student might make it hard to save money, but these helpful budgeting apps will make it a lot easier. Please make the most of your income by utilizing them right away. Have fun!